Rotational grazing fences off vegetation into sections, where it rests and recovers. Cattle are reintroduced later to graze on the new growth.

Published by

on

The Hutsell Farm in Wright County, like Missouri’s other century farms, embodies the state’s hard-working agricultural heritage. Proud to carry on this legacy is David Hutsell, who can attest that finding prosperity in farming means being able to adapt. In that effort, Hutsell credits the cost-share practices of the Soil and Water Conservation Program for helping to make Missouri’s family farm tradition possible for future generations.

“My father was one of the initial founders of the Wright County Soil and Water District many years ago and got our no-till and pest-management practices started, so I’m just trying to carry that on,” said Hutsell. “When my dad first started, he could only run one cow on about three acres, whereas now we can run 10 head on that much ground because of how we’ve improved our soil through these cost-share practices.”

Hutsell is chairman of the Wright County Soil and Water Conservation District’s board in addition to serving as president of the Missouri Association of Soil and Water Conservation Districts. Informing both roles is a lifetime of farming and Hutsell’s recent success at adapting to change. Economic survival for all farmers means sometimes making hard decisions, and in Hutsell’s case, that required fully converting from a dairy farm to a beef cattle operation.

“Wright County was the number one dairy county in the state for years,” Hutsell said. “But dairy farming got to a point where I was taking money from my beef operation to run the dairy operation, so we decided to opt out of dairy in 2018. For me, that transition from dairy to beef was kind of difficult the first year, especially on a farm originally set up for dairy cattle. However, the water source provided through the soil and water grazing management practice was fantastic. The cattle still use that every day.”

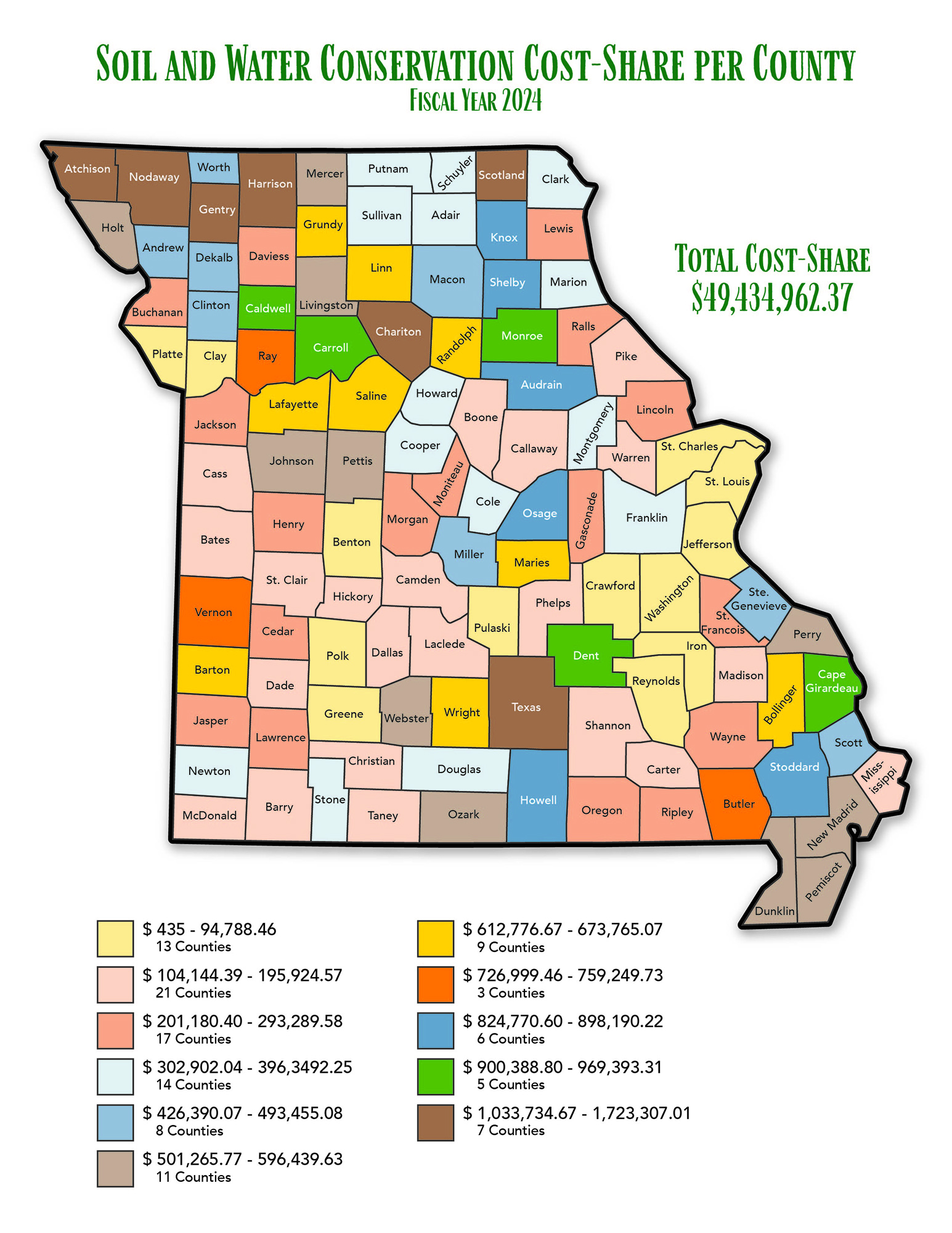

Missouri’s Soil and Water Conservation Program provides cost-share funding for practices that assist landowners in all of Missouri’s 114 counties with conserving their soil and improving their water quality. This is accomplished through the one-tenth-of-one-percent Parks, Soils and Water Sales Tax. Missouri voters first approved the tax in 1984 and have reauthorized it four times. The tax expires in 2028 unless voters again approve it in 2026.

“No one wants to leave the world a worse place for their kids, and I worry enough about what my grandkids are going to have to deal with when I’m long gone. Thanks to the cost-share program, if they want to go to the farm, they’ll be able to go to the farm,” Hutsell said. “Without these programs, it would be much harder to hand things off to the next generation better than where we started. You’re talking a lot of dollars to help our farmers enact these conservation practices. I think last year we put upward of $49 million back on the ground statewide to implement everything from streambank stabilization to helping cover-crop growers hold down their soil.”

Beyond supporting family farms, the Parks, Soils and Water Sales Tax also supports Missouri State Parks. Its funding helps with everything from park maintenance and outreach to making sure admittance into Missouri’s 93 state parks and historic sites remains free of charge.

“These places are something beautiful that God put on this Earth and we’ve got to keep them that way,” Hutsell said. “The closest state park to me is Ha Ha Tonka, but they are all over this portion of the state, and they bring people to this region from everywhere. Our communities benefit from the recreation and tourists our state parks bring by putting dollars into our rural counties.”

Hutsell says he’ll continue to visit state parks and make use of what soil and water conservation practices are available. He only hopes those same opportunities will continue to be available for his kids and grandchildren.

“Most states don’t have dedicated funding like what our tax provides, and when I am at a conference as MASWCD president, they ask me what Missouri is doing right to make this possible,” Hutsell said. “We’re very fortunate that we have these practices and programs from our Parks, Soils and Water Sales Tax. This resource allows us to enact so many improvements and to offer all these recreational opportunities. It’s tough for me to imagine the state without it. If you don’t believe how important this tax is, just go talk to some of the farmers we have across the state.”

To learn more about soil and water conservation and Missouri’s Parks, Soils and Water Sales Tax, visit the department’s Soil and Water Conservation Program webpage.